FAQs for Members

This section provides helpful answers to questions about your membership, retirement, service purchases and planning for life events

For detailed information on your retirement benefit, see the:

Benefits Administration Operating Procedures

Membership Basics

Vesting is an important milestone toward a secure financial future. It means you have established enough service credit to receive a lifetime benefit once you reach eligibility. You are considered vested if you have at least five years of service credit and do not withdraw your accumulated contributions if you terminate City employment. If you have prior service credit with a retirement system that participates in the Proportionate Retirement Program, that service may count toward the five years of service credit needed for vesting.

If you are a vested COAERS member, maintaining your COAERS membership upon leaving City employment is important. In addition to receiving a lifetime monthly benefit payment upon eligibility for retirement, vested membership also offers other benefits. For example, if you were a member of Group A at the time you left City employment, you would retain that status if you return to City employment at a future date. In addition, vested members may have access to health, dental, and vision insurance through the City upon retirement. Death benefits are also provided upon the death of a vested, non-vested, or retired member.

You do have certain responsibilities if you keep your COAERS membership after the termination of your employment. You are solely responsible for timely and properly applying for benefits. COAERS does not pay benefits retroactively. Also, you are responsible for notifying COAERS of your proportionate time in another Texas retirement system which participates in the Proportionate Retirement Program and keeping that information current with COAERS. If you don’t keep this information current, you may lose benefits. You are also responsible for keeping your address, contact information, and beneficiaries current with COAERS. Contact us regularly to keep your account updated and discuss your eligibility for benefits.

By law, as a regular City of Austin employee working 30 or more hours per week, you are automatically a member of COAERS. You contribute a percent of your base pay, excluding overtime, not subject to any limit. Each pay period, your retirement contribution is automatically deducted from your paycheck. Participation is mandatory and you cannot change your individual contribution rate. The City also contributes to COAERS each pay period.

Texas law requires a base contribution equal to 10% of your base pay (excluding overtime and other types of pay).

COAERS provides you with a lifetime retirement benefit once you meet certain eligibility requirements. While you participate by contributing a percentage of your base pay, these contributions do not determine the amount of the benefit that COAERS promises you. Your benefits are determined by a formula which includes your salary and your years of service credit. Contributions are invested by COAERS, under the direction of our Board of Trustees, to provide benefits to all present and future members.

You should always have a completed COAERS Beneficiary Designation Form on file so that at the time of your death, any retirement benefits you may have are paid in accordance with your intent.

Beneficiary Designation Form

See page 4 of our Member Handbook for additional information about naming a beneficiary.

COAERS Member Handbook

Please note, this form must be completed and signed in the presences of a Notary Public. For your convenience, COAERS offers Notary services at our office free of charge.

No, the plan does not allow for loans.

COAERS members have certain responsibilities. We have compiled a few below for you to remember.

- Keep your address current.

- Notify us of your proportionate service frequently. We do not receive proportionate service information from other Texas retirement systems regularly. We rely on members to keep their proportionate service up to date with COAERS through their regular communication with COAERS.

- Timely apply for benefits. COAERS does not pay retroactive benefits back to the date you first became eligible for benefits. Know when you are eligible for benefits and contact COAERS before that time to properly apply for benefits.

- If you are thinking about returning to work with the City of Austin (or COAERS) after retirement, know and understand the restrictions on the receipt of your retirement benefit. You can read about the rules in this handbook or on our website. You can also contact us prior to returning to work for the City of Austin.

- If you are getting divorced, contact COAERS to understand the options regarding your COAERS benefits. If you obtain a Qualified Domestic Relations Order, check the division of benefits to ensure it is correct before a judge signs it.

- Keep your beneficiary designations current.

Your retirement benefits and eligibility date are determined in part by your retirement group, which is determined by your employment date.

- If your full-time, regular employment date is before January 1, 2012, you are in Group A.

- If your full-time regular employment date is on or after January 1, 2012, you are in Group B.

See our Member Handbook for additional information.

COAERS Member HandbookService Credit and Service Purchases

In 1991 the Texas Legislature established a Proportionate Retirement Program for the benefit of members of participating public retirement systems. The current proportionate systems are:

- Austin Police Retirement System

- The El Paso City Employees' Pension Fund

- Employees Retirement System of Texas (ERS)

- Judicial Retirement System of Texas I and II

- Teacher Retirement System of Texas (TRS)

- Texas County and District Retirement System (TCDRS)

- Texas Municipal Retirement System (TMRS)

- Other Texas retirement systems covering municipal employees who have elected to participate in the Proportionate Retirement Program

Combining service credit using the Proportionate Retirement Program may advance your retirement eligibility date but it does not increase the amount of your COAERS monthly benefit. For example, if you have five years of service credit with the Employees Retirement System of Texas and eighteen years with COAERS, your combined service credit for retirement eligibility would be twenty-three years. However, your COAERS monthly benefit payment will be calculated using only your eighteen years of COAERS service credit.

Before relying on service credit from another system, contact that system to verify that your service credit is eligible to be combined with COAERS service credit under the Proportionate Retirement Program and discuss any benefit to which you may be entitled.

Notify COAERS of your proportionate service frequently. Click here for a Proportionate Service Declaration form. We do not receive proportionate service information from other Texas retirement systems regularly. We rely on members to keep their proportionate service up to date with COAERS through regular communication with COAERS. If you believe your proportionate service combined with your other COAERS creditable service makes you eligible for benefits, timely apply for benefits. COAERS does not pay retroactive benefits. Failure to timely apply for benefits could result in the loss of benefits. Know when you are eligible for benefits and contact COAERS before that time to properly apply for benefits.

Additional notes on proportionate service:

- A limited proportionate service arrangement is available for individuals who have membership in a retirement system with the Travis County Healthcare District (Central Health).

- If you purchased military service time under another retirement system, that time is counted only once when combining service credit under the Proportionate Retirement Program.

The primary way to obtain service credit is by working in a regular full-time position and making mandatory contributions to the System (this is called "membership service credit"). However, if you qualify, you can establish additional service credit by purchasing it. There are a number of ways in which you may be able to purchase service credit, as described in the following sections.

Prior Service

If you left the City and withdrew your money, you can reinstate your service credit through a purchase of your prior service if you are reemployed with the City or currently working for a proportionate employer.

Purchasing prior service not only increases your service credit but also increases your retirement benefit payment.

Military Service Leave of Absence (USERRA)

You can purchase service credit if you had to leave your City job to perform military duty and chose not to continue making retirement contributions while you were deployed.

When you return, depending on your length of service prior to your military assignment, you generally have between 14 and 90 days to return to your City job. Once you are back, you must purchase your military service within five years of returning.

Purchasing military service not only increases your service credit but also increases your retirement benefit payment.

THE FOLLOWING SERVICE CREDIT PURCHASES CAN ONLY BE MADE AT THE TIME OF RETIREMENT:

Sick Leave Purchase

At retirement, you may purchase unused sick leave hours to convert them to service credit. A sick leave purchase does not make you eligible to retire any sooner, but it will increase your monthly benefit payment. Unused sick leave hours eligible for cash payment may not be converted to service credit.

You should start the conversion process 30 to 90 days before your retirement date. You must purchase your sick time in 80-hour pay period increments. To make the purchase, you will pay the current contribution rate at the time of retirement to convert the hours to service credit.

Prior Military Service

You can purchase a minimum of 90 days and up to 48 months of service for full-time, active duty that you completed in the Armed Forces of the United States prior to working for the City. You will need to provide your DD214 Form to receive this credit.

Non-Contributing Service

You can purchase service credit representing certain employment periods with the City in which you would not have made COAERS contributions. Some examples include:

- You worked for the City in a temporary or part-time position

- You were on an approved leave of absence

- You were on Workers Compensation leave due to an on-the-job injury

In addition, up to six months of non-contributing service can be purchased for probationary period employment for those who were hired prior to October 1, 1995, but were not still employed by the City on October 1, 1995. If you were an active contributory member of COAERS on October 1, 1995, you were given credit for this period at no charge to you.

Purchasing non-contributing service not only increases your service credit but also increases your retirement benefit payment.

Supplementary Service Credit

Once you have five years of COAERS membership service credit, you can purchase up to 60 months of additional service credit at the time of retirement.

- Group A Supplementary service credit will increase your monthly benefit payment and will also count toward your retirement eligibility.

- Group B Supplementary service credit will increase your monthly benefit payment but will not count toward your retirement eligibility.

You may be required to purchase prior service before you can purchase supplementary service credit. Please contact our office for more information.

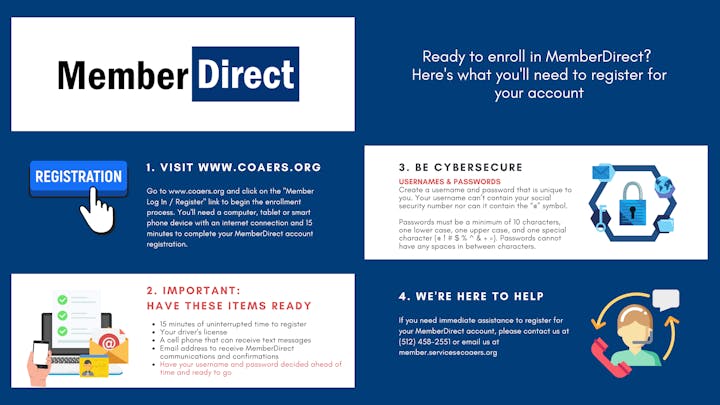

Run an Estimate via MemberDirect

MemberDirect is the easiest way to request and access a service purchase estimate. Log on to MemberDirect, then selec "Estimate a Benefit" to run an estimate. If you don't have a MemberDirect account, select the "Member Login/Registration" button on the COAERS webpage and follow the instructions to enroll.

Submit a Request for Purchase Calculation Estimate Form

Members can complete and submit the form linked below to request a service purchase estimate from COAERS.

Request for Purchase Calculation EstimatePurchase calculations can take 4-6 weeks and will be mailed to your home. If you intend to retire using proportionate service, please indicate on the form, because it affects your purchase cost. All purchase calculations are subject to audit and correction. Click here to see the monthly deadline dates for service purchases.

As we transition to our new office location, forms and paperwork can be submitted via our secure upload portal on MemberDirect or postal mail. Access to the After Hours Secure Drob Box has been temporarily suspended.

City of Austin Employees Retirement System

4700 Mueller Blvd, Suite 100

Austin, TX 78723

For questions about document or form submission, please contact us at member.services@coaers.org or (512)458-2551.

If you would like to inquire about purchasing service credit and rolling in money from another retirement system to pay for the purchase, log on to MemberDirect to estimate your purchase cost and contact us at (512) 458-2551 about the next steps.

Once you receive a service purchase estimate, members must contact COAERS to initiate, review, and complete a signed service purchase agreement.

For assistance, please contact Member Services at (512) 458-2551 or member.services@coaers.org to schedule an appointment.

You can pay for the service purchase via check and money order. You can also pay by rolling in money from certain types of other retirement plans including the City’s Deferred Compensation plan.

Please be aware that COAERS does not accept any rollovers from Roth IRA accounts when making a service purchase.

Life Events

If you leave your City job, you have several choices when it comes to your COAERS membership.

Option 1: Discontinue your membership and refund your contributions. Submit a Refund Application:

Refund Application PacketThe Refund Application initiates the process of refunding your COAERS deposits. If you decide to obtain a refund of your deposits and terminate your COAERS membership, the application must be signed in the presences of a Notary Public. For your convenience, COAERS offers Notary services at our office free of charge.

Option 2: Keep your contributions in COAERS and retain your membership. You can leave your contributions on deposit and retain your membership, service credit and your group status. Leaving your money in the COAERS system also qualifies you for death benefits.

You do have certain responsibilities if you keep your COAERS membership after the termination of your employment. You are solely responsible for applying for benefits. COAERS does not pay benefits retroactively back to the date you were first eligible for benefits. Also, you are responsible for notifying COAERS of your proportionate time in another Texas retirement system which participates in the Proportionate Retirement Program and keeping that information current with COAERS. You are also responsible for keeping your address, contact information, and beneficiaries current with COAERS.

Contact us regularly to keep your account updated and discuss your eligibility for benefits.

- Receive your refund as a lump-sum payment

- Roll over all or a portion of your account

As a vested member (5+ years of service), you can retain your COAERS membership, service credit and, if you were a COAERS member prior to January 1, 2012, your Group A status and corresponding eligibility requirements. Upon re-employment with the City, your previously earned service will be used in determining your retirement benefits.

You also can also refund your contributions, discontinue your membership and receive a lump-sum payment or roll over all or part of your funds.

You should receive your refunded contributions 60-90 days after you submit your Refund Application. Before we can release your funds, COAERS must receive proper documentation, your employment status with the City must be "terminated" and your final paycheck issued.

Texas is a community property state, so any COAERS benefits you earn during marriage may be divided by a court in a divorce proceeding. If, during a divorce proceeding, it is determined that you will keep 100% of your COAERS benefit, we do not need any paperwork from you. However, if it is determined that you and your spouse will be dividing your COAERS benefit, you will need to submit a Qualified Domestic Relations Order (QDRO). A QDRO is a special legal order which is signed by the judge who has jurisdiction over your divorce. It tells us what portion of your retirement contributions or monthly retirement benefit to pay to your spouse and the form of payment (lump sum or annuity) after your divorce is final.

For COAERS to pay benefits to a former spouse (also called an alternate payee), the QDRO must meet specific requirements. QDROs that do not meet COAERS requirements will not be honored, which could result in delays and additional legal costs. A model QDRO form is available on this website under the Resources/Forms tab for attorneys to use to draft the QDRO correctly. It is strongly recommended that you or your attorney present the QDRO to us prior to the finalization of your divorce. Our Member Services Specialists are also available to discuss the effects a QDRO can have on your contributions or monthly retirement benefit. Just contact us to set up an appointment.

If you are eligible to retire at your death, your surviving spouse has the following options:

- The active member lump-sum death benefit described below for members who die before being eligible for retirement

- Monthly survivor benefit payments in the form of Options I, II, III, or IV

- Fifteen years of payments in the form of Option V (the 15-year certain and life option)

You can direct which benefit your spouse receives upon your death by predesignating a retirement option. For more information, please contact our office.

A sole non-spouse beneficiary is eligible only to receive fifteen years of monthly benefit payments in the form of Option V. If multiple beneficiaries are named, these beneficiaries are eligible only to receive the active member lump-sum death benefit described below.

Whether a spouse or a non-spouse, the beneficiary receiving monthly benefit payments will also receive a one-time, taxable $10,000 death benefit. This death benefit is not paid to the beneficiaries who receive an active member lump-sum benefit.

Please note that distributions from COAERS may be subject to income tax. A distribution made to your beneficiary is taxable and they will receive a 1099-R at the beginning of the following year that will include taxable and non-taxable benefits as reported to the IRS.

If you are not eligible to retire, your contributions and service purchases plus interest, plus a death benefit, will be paid to your beneficiary..

If you become disabled in a manner that is likely to be permanent and prevent you from performing any type of employment duties, you may be eligible for a COAERS disability retirement benefit. This benefit will allow you to retire immediately and receive a monthly benefit payment for life based on your years of service. If you believe you may qualify for disability retirement, see the Disability Retirement Application Process on our Forms link for more information.

Retirement Planning

Your eligibility depends on your group, which is determined by your membership date.

Normal Retirement:

Group A (Employees who became members before January 1, 2012)

If your full-time, regular employment date is before January 1, 2012, you are eligible for normal retirement and can receive a monthly benefit payment for life when you meet one of these requirements:

- You reach age 62*

- You reach age 55 and have at least 20 years of service credit

- You obtain at least 23 years of service credit regardless of your age* To retire at age 62 you must be one of the following:

- An active contributing member when you turn age 62

- A terminated vested member with at least 5 years of COAERS service credit

A proportionate member with 5 years of combined service credit

Group B (Employees who became members on or after January 1, 2012)

If your full-time, regular employment date is on or after January 1, 2012, you are eligible for normal retirement and can receive a monthly benefit payment for life when you meet one of these requirements:

- You reach age 65 and have at least 5 years of service credit

- You reach age 62 and have at least 30 years of service credit

Early Retirement (Group B only):

Early retirement is not applicable to members in Group A. If you are a member of Group B and you have attained age 55 and have at least 10 years of service credit, you are eligible for early retirement benefits. Early retirement benefits are reduced because you will be receiving benefits before your normal retirement date. The reduction depends on your age in years and months at the time you retire.

Supplementary service credit does not count towards normal or early retirement eligibility for Group B members.

See pages 5-7 of our Member Handbook for additional information about retirement eligibility.

Normal Retirement

Once you become eligible for retirement, your benefits are calculated based on your salary, years of service credit, and the group to which you belong. At retirement, you may choose to receive a lifetime annuity benefit as an individual, known as a life annuity, or you may choose an option that provides benefits for yourself and a survivor. Click here for a description of these options.

Formulas for Calculating a Lifetime Annuity as an Individual

Group A Normal Retirement Life Annuity Formula

Final Average Monthly Pay* x Years and Months of COAERS Service Credit x 3% = Monthly Life Annuity

Group B - Normal Retirement Life Annuity Formula

Final Average Monthly Pay* x Years and Months of COAERS Service Credit x 2.5% = Monthly Life Annuity

"Final Average Monthly Pay" is the average salary for the highest 36 months you contributed to COAERS during the last 10 years. For most members, this is the average of the last three years worked.

Early Retirement (Group B only)

Early retirement benefits are reduced because you will be receiving benefits before your normal retirement date. The reduction is applied to the benefit you would otherwise receive at your normal retirement date. Click here for more information.

Member can make in-person, telephone and virtual appointments for any of the following services:

Apply for Retirement

Complete Death Benefit Paperwork

Complete Refund Application

Discuss Retirement Planning

Discuss Service Purchases

Request MemberDirect Assistance

To schedule an appointment, visit our website at www.coaers.org/contact.

When you are within two years of retirement eligibility, you can register for a Pre-Retirement Seminar. Seminars are currently held monthly and are accessible virtually. To register for a seminar, please login and sign up via the COAERS MemberDirect portal.

To find the next available seminar and register online, visit our calendar of event, or call us at (512) 458-2551 to make a reservation. Please be prepared to let us know your target retirement date.

One of the key components in determining your retirement benefit from COAERS is final average pay. Here's a brief description of how your pay plays a part in your retirement benefit.

The pay that COAERS uses to determine your retirement benefit is base pay. More specifically, your hourly rate for a normal 80-hour pay period is used. This means that your retirement benefit is not based upon overtime or other types of pay that you might receive. At retirement, your final average pay is determined by averaging the highest 36 months of base pay out of the last 120 months of base pay prior to your retirement date. Certain highly compensated members may be subject to limits placed upon their final average pay due to Internal Revenue Code requirements. The limits have been: $265,000 for 2015; $265,000 for 2016; and $270,000 for 2017.

Final average pay is then multiplied by your total service credit then multiplied by either 3% for Group A members or 2.5% for Group B members to determine your lifetime monthly retirement benefit.

If you are close to retirement eligibility, you will want to obtain an estimate of your retirement benefits, which includes details about the calculation of final average pay.

To obtain an estimate, log in to MemberDirect to run as many estimates as you'd like. You can also request a benefit estimate by submitting a completed "Request for Retirement Benefit Estimate" form, which can be found in the forms section of our website.

Your retirement benefit formula establishes the monthly benefit for your life only. However, you may choose another type of benefit payment option at retirement. An example is an option that allows your spouse to continue receiving a monthly benefit payment if you die first. If you choose a payment option other than a life annuity, your lifetime monthly benefit will be reduced to reflect the additional cost of the payment option you choose. Click here for a description of these options.

If you are married, your spouse must consent to the benefit payment option you choose at retirement. You cannot change your payment option or your survivor after retirement. Even if you and your spouse divorce after retirement, you cannot name another survivor.

Your effective date of retirement is always the last day of the month. For example, if you are eligible to retire, complete the application process for retirement, and terminate employment from the City of Austin on June 15, your effective date of retirement will be June 30, and you will receive your first monthly benefit payment on the last business day of July.

If you have terminated City of Austin employment, have kept your funds in COAERS, and have five or more years of Service Credit, you are considered a vested Member and are entitled to receive retirement benefits upon reaching retirement eligibility and making a written application for retirement.

These are the steps to apply for retirement:

- Request a retirement benefit estimate by completing the Request for Retirement Benefit Estimate form and submitting it to our office.

- Call to make an appointment to meet with a Member Services Specialist in our office. If you are married, your spouse should accompany you to the appointment, because your spouse must consent to your choices and sign your retirement documents.

- Complete the Notice of Intent to Retire form that your Specialist will give you and submit it to our office 30 days prior to the month in which you are retiring.

The Internal Revenue Code sets limits which may affect service purchases, final average pay, and annual benefits. These limits affect very few people. We will notify you if these limits affect you when you make a service purchase or retire.

- Service Purchases. The Internal Revenue Code places limits on certain purchases of service which may impact the amount of time you may purchase or may impact your future retirement benefit.

- Final average pay. The Internal Revenue Code may limit the pay used to determine your final average pay which is a component of the formula used to determine your monthly retirement benefit. These limits only apply to highly compensated members.

- Maximum Annual Benefit. The maximum annual retirement benefit payable to a COAERS member is subject to limits and can vary depending upon the age of the member. Retirement benefits which exceed these limits can still be paid, but are paid from a separate plan.

Making the decision to retire can be an exciting one. Once you have decided to retire, please follow these steps in the retirement process checklist and visit www.coaers.org/ready-to-retire for more information.

APPLYING FOR RETIREMENT WITH COAERS: THE RETIREMENT PROCESS AND CHECKLIST